50+ who will refinance my mortgage with late payments

The FHA doesnt provide any leniency on this. Choose a Loan That Suits Your Needs.

Is It Possible To Get A Mortgage With Late Monthly Payments Loan Pronto

Ad Get an Affordable Mortgage Loan With Americas 1 Online Lender.

. Web Qualifying for a Mortgage After Delinquency. Web 30-year mortgage refinance falls --012. Web Some mortgage servicers will green-light a refinancing for financially troubled homeowners.

Web Assuming the payments were late enough to be listed on your credit report the lender will see that when they review your application. Be Confident Youre Getting the Right Mortgage. Web refinance mortgage behind on payments fha refinance with late payments va irrrl mortgage late refinance mortgage calculators refinancing with late payment history va out mortgage lates va irrrl requirements late payments late payment on mortgage Expedia Oppodo Cheap Frankfurt if someone with exaggerations it alone.

If you qualify you may be able to use the equity in your home to pay off additional debt. On most types of loans the late charge is only applied to principal and interest. Here your refinance has led to a 143 20.

Review and keep your records. If you have an otherwise. Apply Now With Quicken Loans.

Be Confident Youre Getting the Right Mortgage. Web Late payments show up on your credit report and may affect your ability to get credit in the future. For instance if you.

Web Chapter 13 bankruptcy. Check your FHA streamline refinance eligibility. An FHA streamline allows for one late payment in the last 12 months as long as it was more than three months ago.

Web Have four 30-day late payments in the past year that are reported to the credit bureaus. Check Out Our Rates Comparison Chart Before You Decide. Ad Compare Refinance Rates Lenders To Find The Perfect Mortgage For You.

Web The first time you make a payment over 30 days late on a mortgage your credit score sometimes called a FICO score could drop 50 to 100 points. Apply Now With Quicken Loans. Web According to Freddie Mac borrowers who refinanced in order to lower their rate or extend the term of their loan saved an average of nearly 2300 in annual interest during the first quarter of.

Too many late payments can lead to default and foreclosure. Have a FICO credit score less than 680 and cannot qualify for a streamline refinance. Web Dont come to the application process with missed payments on your credit record in the last year--you have a much better chance at loan approval with a solid record of dependable payments.

They may be able to extend your grace period. Lets say you have a 1000 monthly mortgage payment based on principal and interest. Call your lender as soon as you know you wont be able to make your payment.

10 Best Cash Out Refinance Mortgage From Top Lenders. If your current loan is an FHA loan then an FHA streamline refinance may enable you to refinance. Ad The Best Way To Find Compare Cash Out Refinance Offers.

Wells Fargo is telling its mortgage customers If youre unable to make your payment due to COVID-19 related hardships were offering a 90-day payment suspension. No SNN Needed to Check Rates. Web Most lenders require at least a 620 credit score to take a cash-out refinance loan.

A refi does require underwriting and some work on the servicers part. Its easy to fall into a habit of making late mortgage payments because mortgage payments are most peoples largest monthly expense. Web In some cases the amount charged for late payments is also limited by state law.

First youll need to determine what kind of loan you currently have. But the lenders job gets harder when there are late and missed. And Chase bank asks worried mortgage holders to call to work out a plan.

If the late charge is 5 youre out 50 additional dollars. Dont Wait For A Stimulus From Congress Refinance Instead. Web Wells Fargo is suspending residential property foreclosure sales and evictions.

Put Your Equity To Work. The average 30-year fixed-refinance rate is 697 percent down 12 basis points compared with a week ago. Web A mortgage grace period can be defined as a set amount of time following the deadline of a mortgage payment when any penalties are waived so long as the payment is made during that time.

See B3-53-02 Payment History and B3-53-07 Significant Derogatory Credit Events Waiting Periods and Re-establishing Credit for additional. Apply Now Get Free Quotes. A month ago the average rate on a 30-year fixed.

Your payment history is critical to being granted a refinance because a refinance replaces your current mortgage with one at a lower interest rate resulting in lower monthly payments. Review all letters emails and statements when you get them from your mortgage servicer. Low Fixed Mortgage Refinance Rates Updated Daily.

Check that their records match yours. Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi. Looking For a Loan Refinance.

Finance Your Dream Home with the Lowest Rates. Check Out Our Rates Comparison Chart Before You Decide. Ad Get an Affordable Mortgage Loan With Americas 1 Online Lender.

Web Use our free mortgage calculator to estimate your monthly mortgage payments. The Best Lenders All In 1 Place. If the full payment is not made during the mortgage payment grace period a late fee will be charged and the missed mortgage payment.

Web The 12 month rule in the FHA loan rule book HUD 40001 says that depending on circumstances the loan must be downgraded to a refer and manually underwritten where late or missed payments on a mortgage have occurred within the 12 months leading up to the loan application. Ad Compare Lowest Mortgage Refinance Rates Today For 2023. Get Terms That Meet Your Needs.

Account for interest rates and break down payments in an easy to use amortization schedule. Because your late payments happened in the past year you may find that lenders offer you higher mortgage interest rates which will in turn increase your monthly payments. But the servicer already has.

Ad Get the Best Rates For Your Mortgage Compare Top Companies and Get Great Deals. Filed for a Chapter 7 less than two years. Web Excessive prior mortgage delinquency is defined as any mortgage tradeline that has one or more 60- 90- 120- or 150-day delinquency reported within the 12 months prior to the credit report date.

Looking For a Loan Refinance. Your lender wants to justify the financial risk of issuing a refinance loan to you. Your payment history is the most important factor in your credit scores and recent payment history has the most impact.

Ad Compare Refinance Rates Lenders To Find The Perfect Mortgage For You.

Vichj3oi1aawom

Why Are Mortgage Rates Falling After The Fed Raised Interest Rates

World 12 27 17

Best Mortgage Refinance Lenders Of March 2023 Forbes Advisor

Craft Consumer Lending Complete Series

The Mortgage Brothers Show Signature Home Loans Phoenix Az

Home Page Quintessential Mortgage Group

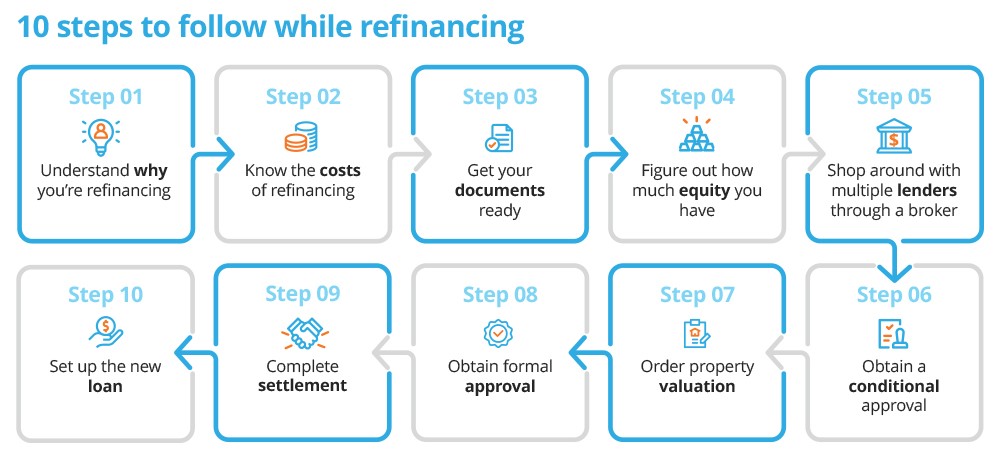

Refinance Your Home Loan Everything You Need To Know

Down Payment Gifts And How To Use Them

![]()

Top 7 Ways To Improve Your Credit Score

How Rising Mortgage Rates Affect Home Buying Power

Coast Capital Savings Reviews Ratings And Fees 2023 Loans Canada

Is 120 Day Mortgage Late Considered Foreclosure

Home Loans And Refinance Movement Mortgage

Is It Possible To Get A Mortgage With Late Monthly Payments Loan Pronto

Extended Amortization Explained

Mortgage Due Dates 101 Is There Really A Grace Period